Mumbai leads pan-India Industrial & Logistics leasing with 22% Y-oY growth at 5.3 mn. sq. ft. in Jan-Sep’23

- City accounts for 19% share in pan-India leasing in Jan-Sep’23

- Third-party Logistics, Engineering & manufacturing and FMCG sectors dominated absorption

Mumbai – CBRE South Asia Pvt. Ltd., India’s leading real estate consulting firm, today announced the findings of its report, ‘India Market Monitor Q3 2023’.

The report highlights the growth trends and dynamics across the real estate sector in India.

According to the report, Mumbai led pan-India Industrial & Logistics space absorption activity among the top 8 cities in India with a 19% share in the overall leasing activity during the Jan-Sep’23 period. The total absorption in Mumbai during this period stood at 5.3 mn sq. ft., compared to 4.3 mn. sq. ft. in Jan-Sep ’22, registering a growth of 22%. Third Party Logistics, Engineering & manufacturing and FMCG companies dominate absorption in Jan-Sep’23. The city also recorded a supply addition of 3.4 mn sq. ft. during the Jan-Sep’23 period.

During the Jul-Sep’23 quarter, total leasing in the city stood at 1.3 mn sq. ft. and a supply addition of 0.9 mn sq. ft. was recorded.

On a pan-India basis, the Industrial & Logistics sector is likely to touch a 5-year high absorption mark and touch 36 – 38 mn. sq. ft. in 2023 across top 8 cities in India. Supply addition, too, is expected to outperform, touching 35 – 37 mn. sq. ft. by the year-end, driven by the completion of pent-up projects.

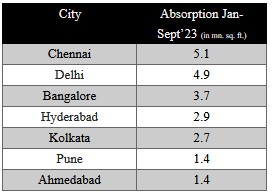

The leasing in the I & L sector grew by 13% Y-o-Y in the Jan-Sep’23 period. The total absorption across the top 8 Indian cities stood at 27.3 mn. sq. ft, compared to 24.2 mn. sq. ft. in Jan-Sep’22. Mumbai, Chennai, and Delhi-NCR collectively accounted for a share of 56% in the leasing activity during the Jan-Sep’23 period.

During the Jan-Sep’23 period, Third-party Logistic (3PL) players dominated leasing with a 45% share, followed by Engineering & Manufacturing (E&M) companies (15%), ancillary (7%), FMCG (6%) and Electronics & electricals (5%). Supply addition was registered at 28 mn. sq. ft., recording a 57% Y-o-Y increase in Jan-Sep’23. A combined contribution of 56% has been recorded in supply additions during the Jan-Sep’23 period from Delhi-NCR, Chennai, and Kolkata collectively.

In Jul-Sep’23, among the cities, Chennai recorded the highest absorption with 2.1 mn. sq. ft., followed by Bangalore and Mumbai, recording 1.7 mn. sq. ft. and 1.3 mn. sq. ft., respectively. The combined leasing share of these three cities accounted for approximately 62%. During the Jul-Sep’23 quarter, 3PL players accounted for 50% of the leasing activity, followed by Engineering & Manufacturing at 13%, and Electronics & Electrical companies at 8%.

As per the regional trends, domestic corporations took the lead in leasing activities with a 59% share, followed by EMEA corporations at 25% and APAC corporations at 12% during the same period.

The I&L sector also witnessed a 92% Y-o-Y increase and 12% Q-o-Q growth in warehouse completions in the July-Sep’23 quarter.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said, “We are witnessing a remarkable shift in the I&L sector. With the surge in quality supply additions, robust festive demand, and the completion of pent-up projects, we anticipate the overall absorption to touch a 5-year high, reaching an impressive 36-38 million square feet by the end of 2023. Moreover, the active participation of larger developers backed by institutional funds, contributing around 40% to the completed projects, underscores the sector's growth potential. In select micro-markets, the prospect of rising rents is bolstered by the premium commanded by new, investment-grade, technologically advanced, and strategically situated assets.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “As we delve into the Industrial and Logistics landscape, it is clear that dynamic shifts mark the path forward. The accelerated embrace of multipolar; supply chain strategies, complemented by the government’s pro-investment initiatives, continues to propel the 3PL and Engineering & Manufacturing sectors, being at the forefront of absorption.

We also anticipate a surge of interest from FMCG, retail, and electronics & electrical sectors, driven by consumer demand. Additionally, domestic corporate have taken the lead in leasing activities, capturing a substantial 59% share, with EMEA and APAC Corporate contributing significantly at 25% and 12% respectively during the Jul-Sep’23 period”.