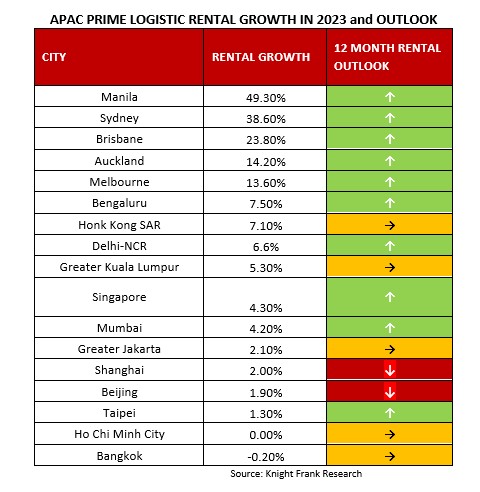

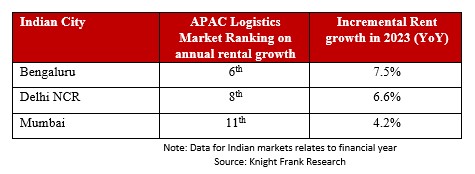

Bengaluru and Delhi-NCR among top 10 APAC logistics markets in terms of annual rental growth in 2023: Knight Frank

Mumbai, According to Knight Frank’s Asia-Pacific Logistics Highlight H1 2023 report the Asia-Pacific (APAC) logistics market saw a rental growth of 10.4% in year-over-year (YoY) terms. 15 of 17 tracked cities recorded increasing rents in H1 2023. The key Indian cities Bengaluru and Delhi-NCR consolidated their position to remain among the top 10 APAC markets in terms of warehousing rent growth in H1 2023, while Mumbai is placed 11th. Data for Indian markets relates to the financial year.

The report, which tracked prime logistics rent across 17 key cities across APAC, showed an average rise of 10.4% year-over-year in rental values, powered by the acceleration of rental growth in Manila. This growth defies the significant economic challenges that prevailed during the same period. The overall rise was largely fuelled by resilient demand from e-commerce, third-party logistics (3PL) entities, and manufacturers.

Most Southeast Asian cities tracked in the report recorded stable or improved rents, with Manila recording the highest rental growth of 49.3% year-on-year in Asia-Pacific, fueled by sustained demand from e-commerce. Preference for institutional-grade facilities in core areas and last-mile locations continued to propel leasing activity in the region, while the China+1 strategy also saw ongoing expansions by major manufacturers in Southeast Asia. In Australasia, limited availability drove the broad – based rental growth as vacancy rates, especially in the Eastern Seaboard continued to sit at record-low levels. Despite a peak in the development cycle that the region attained in 2023, with each of the three major marketing expecting estimated 800,000 – 900,000 sq m of new supply, over 50% of the pipeline is already pre-committed and therefore the undersupply situation is expected to continue in the markets of Australia and New Zealand.

Demand in the three main Indian warehousing markets continues to be sustained at near-record levels. Mumbai and Bengaluru experienced healthy growth in leasing transaction volumes as vacancies tightened rapidly through the last six months. Activity in Delhi-NCR slowed marginally, albeit from the high base set in the previous period. Rents continued to rise in the first half of 2023 due to sustained demand and an increase in input costs. Although e-commerce demand was observed to have decreased, manufacturing and 3PL players have plugged the gap. However, as consumer demand continues to remain strong, the e-commerce sector is expected to stage a recovery once excess capacities built up during the pandemic are absorbed.

Bengaluru is placed 6th in the APAC logistics market based on annual rental growth. Rents in the city grew 7.5% YoY to INR 21.50 /sq ft/ month, compared to INR 20/sq ft/ month last year. Vacancy level is at a healthy 15.8%, significantly lower than the 28.2% previously.

Delhi-NCR is positioned 8th in the APAC logistics market based on annual rental growth. At INR 20.20/ sq ft/ month, the city’s rents grew at 6.6% YoY compared to INR 19/ sq ft/ month last year. The vacancy level has dropped to single digits in the latest period and currently stands at 9.7%.

Mumbai is on 11th position in the APAC logistics market in terms of annual rental growth. Mumbai is the most expensive warehousing market in the country. With a YoY growth of 4.2%, the city’s rents now stand at INR 23.06 / sq ft/ month, compared to INR 22/ sq ft/ month. The vacancy level has also dropped significantly to 10.3% from 14% in the previous year.

Shishir Baijal, Chairman & Managing Director, Knight Frank India said, “With India emerging as one of the fastest growing major economies in the world, business activities across the country is moving firmly along the growth path. The Indian warehousing sector in particular has been a standout performer. Transaction volumes in FY23 have equaled the record-breaking levels of FY22. Demand from the e-commerce sector is expected to recover in the coming months and this is expected to keep the market buoyant along with the rising demand from manufacturing and 3PL sectors.”

Christine Li, head of research at Knight Frank Asia-Pacific, said “Conditions within the Chinese mainland market are displaying a divergence from the rest of the region, as its economy continues to underperform. However, this is counterbalanced by more positive sentiment in other areas, where the growth in demand outpaces the supply of new units. Long-term structural fundamentals also continue to underpin demand in emerging Southeast Asia markets, alongside India, which is progressively gaining significance within the global manufacturing supply chain. Overall, the region’s logistics sector remains in adjustment mode, as e-commerce demand continues to adapt to a new cycle in the post-pandemic environment, which will persist into the second half of 2023. We expect supply-side induced rental increases to moderate as occupiers adopt a more selective approach and prioritise future-proofing their logistics footprints.”